Unicorn herders - Dealrooms' worlds' best VC map includes Polish funds

Dealroom aggregates information on startups and tech investments from around the world. What makes it different from its competitors like Crunchbase or AngelList is a much stronger focus on European ecosystems. Therefore, all reports prepared by this company are particularly interesting for the Polish ecosystem. The ranking of the top 500 VC funds in the world published at the beginning of this month also includes Polish investors.

Dealroom aggregates information on startups and tech investments from around the world. What makes it different from its competitors like Crunchbase or AngelList is a much stronger focus on European ecosystems. Therefore, all reports prepared by this company are particularly interesting for the Polish ecosystem. The ranking of the top 500 VC funds in the world published at the beginning of this month also includes Polish investors.

Americans dominate the top 50

'VC Investor Ranking' report from the European aggregator is the sixth edition of the ranking. Its creators primarily analyze the outcomes of fund investments, taking into account the number of unicorns - startups valued at more than a billion dollars, as well as 'future unicorns' – companies whose valuations are growing and currently exceed half a billion dollars.

Among the top fifty funds, 40 are American entities. It reflects both the maturity of the market and the substantial funding of technological startups from Silicon Valley. Still, Europe does not necessarily play second fiddle in terms of financing – there are five European entities in the top fifty, and an equal number comes from Asia – three from China, one from Japan, one from Singapore. They also occupy higher positions than European funds. When it comes to European funds, there are two British funds, two German ones, and one French in the top 50.

One Polish fund on the global list, two on the European one

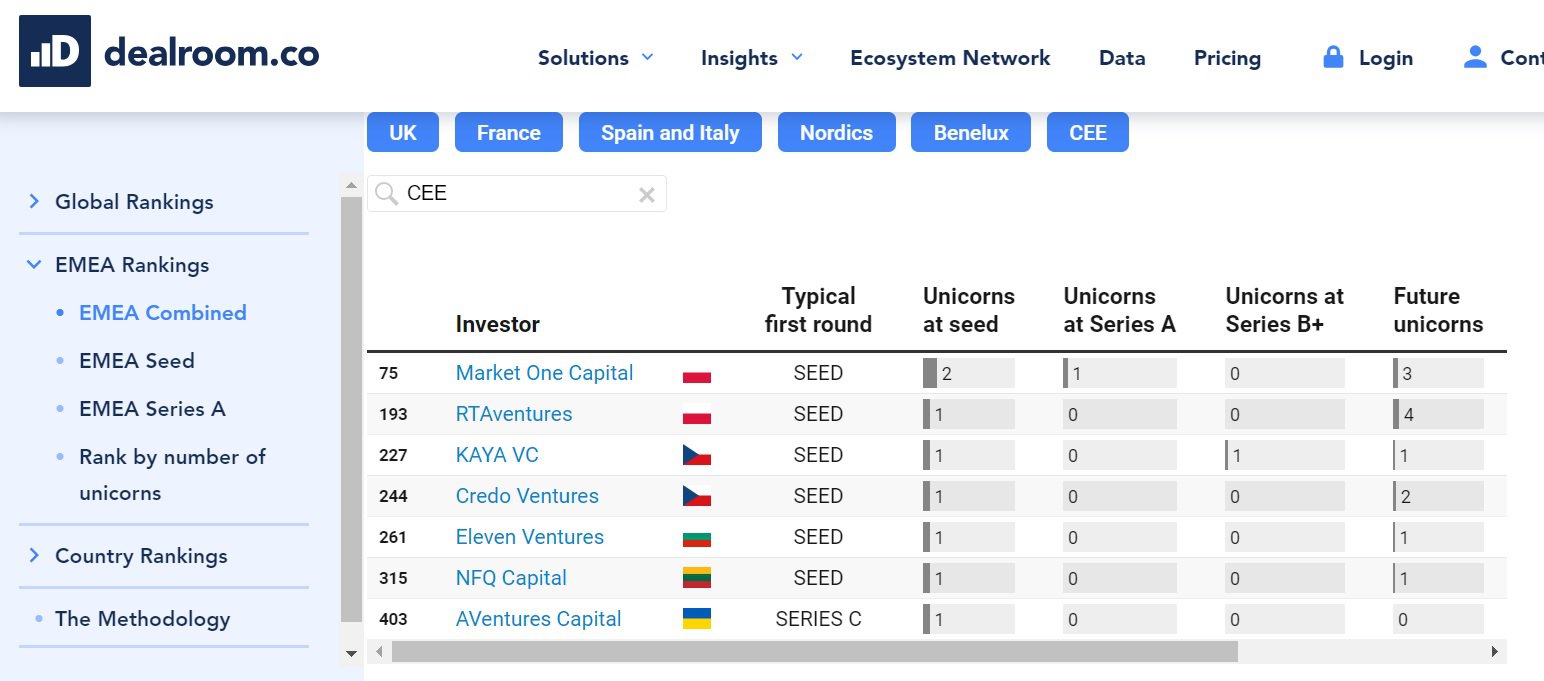

The Polish ecosystem is relatively small on a global scale, but Polish VC funds have made it to the list. Dealroom divided its report into two parts – global one and the one concerning funds investing in Europe. In the global part of the study, one Polish fund – Market One Capital, which has two unicorns, Tier and Jokr in its portfolio, were included. If we only consider investments in Europe, the Polish-German RTA Ventures joins them. It has exited its investment in Booksy and has companies like Docplanner and Infermedica in its portfolio. Both funds rank at the top positions in the CEE region. Apart from them, it's worth mentioning Kaya VC – a Czech fund supported by PFR Ventures, which operates in the Polish market and also has Booksy and Docplanner in its portfolio.

Another Polish fund appears when we look at those investing in later stages – from Series A and beyond. Among these type of funds, Dealroom includes OTB Ventures, with a portfolio of 'future unicorns' such as ICEYE and Cosmose, as well as the Lithuanian fund Kevin. If we focus solely on seed-stage funds, we can also add Kulczyk Investments, which funds Booksy and Brainly, and Alfabeat, which exited its investment in Wolt.

Will the situation of Polish funds change? Our ecosystem is maturing, and perhaps it won't surpass investors from the Silicon Valley, but when startup valuations are more likely to decrease than increase, Polish funds may start to operate more actively on the international stage and support growing companies more strongly.