A record year for Polish VC! PFR Ventures report summarizing 2020

Achieving an increase in the value of investments by PLN 861 million compared to the previous year is a success. To do so in a year dominated by the coronavirus pandemic is a real feat! Read the report published by PFR Ventures, summarizing transactions on the Polish VC market in 2020.

Last year 158 funds invested PLN 2.1 billion in 300 companies. The value of investments in 2019 amounted to slightly more than 1.2 billion. PLN. This means that despite the downturn that took place across the EU in 2020, VC funds multiplied their investment 1.7 times.

Record funding has been won by three brands racing for the title of the Polish unicorn:

-

ICEYE mega-round of PLN 331 million.

-

Booksy mega-round: PLN 266 million.

-

Brainly mega-round: PLN 302 million.

- In 2020, we have noted another record on the Polish venture capital market. Three transactions ranging from PLN 250 million to PLN 350 million have market the main candidates for the title of the Polish unicorn. This does not mean, however, that in 2021 there will not be a "black horse" candidate. The largest transactions account for slightly more than half of the capital provided yearly by the funds. Despite this, excluding these highest transactions from 2019 and 2020, we can talk about a 30% growth of the venture capital market year-over-year (or by 70% when including them). The average value of investment rounds is also growing - summarizes Aleksander Mokrzycki, Vice President of the Management Board of PFR Ventures.

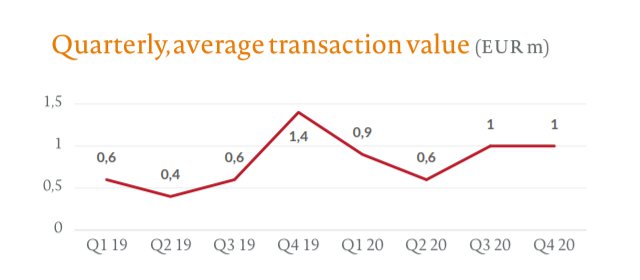

The second half of the year was particularly abundant. In the fourth quarter of 2020, the average value of VC transactions in Poland amounted to PLN 4.3 million. This is a slight decrease compared to the very successful third quarter, in which the value was PLN 4.4 million.

- In 2020, we achieved a record in terms of the average value of VC investments in our market, recording a 52% increase when compared to 2019. This proves the continued optimism in the investors' perception of the Polish start-up ecosystem - said Klaudia Babraj, analyst at PFR Ventures.

The year-over-year increase was visible at every stage of financing, however, it is particularly important to notice the double increase of Series A (26 transactions in 2020) and the triple increase of Series B rounds (6 such investments in 2020).

- Looking at these data, I am convinced that this year will be even more abundant in both early investments and larger (B +) rounds, which will also be noticeable abroad. As Inovo, we invest in the early-stage companies, so we have a lot of work ahead of us! - pointed out Maciej Małysz, partner at Inovo Venture Partners.

It is worth adding that public-private capital was responsible for as much as 62% of the transaction value. Looking at investments from the quantitative point of view, public-private funds participated in as many as 258 out of 310 transactions. The capital of PFR Ventures funds accounted for as much as 29% of transactions, which puts it in second place after the international private investors. The third place on the podium was taken by investments made by the NCBR (National Centre for Research and Development) - 21%. The data does not include outliers, i.e. three record investments.

- Surprisingly, the VC market is not afraid of coronavirus. The PLN 2.1 billion invested is almost a billion more than a year ago. The NCBR funds generated 21% of this sum. In terms of the number of transactions, it looks even better - we stood behind almost a half of them. Perhaps the crisis caused by the pandemic made VC funds even more attractive, and investments in innovation - a way to "escape forward" - said Przemysław Kurczewski, NCBR deputy director responsible for R&D investments.

In the case of international capital sources, American investors' funds were definitely the leader, accounting for almost 45% of the value of foreign fund transactions in 2020. British funds, whose capital exceeded 20% of the value of foreign investments last year, came second.

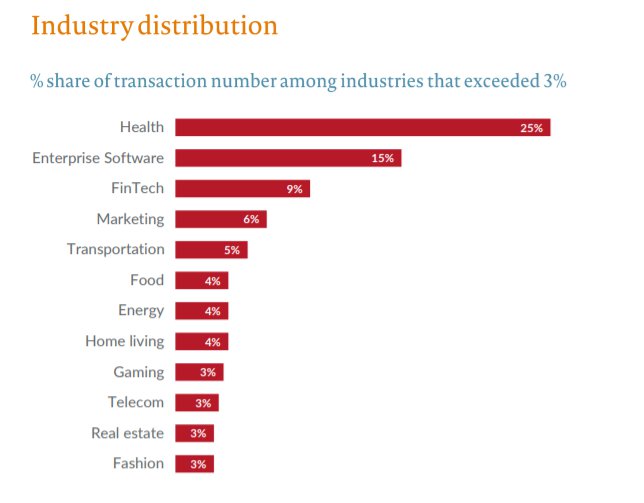

Importantly, investors were the most optimistic about companies from the health, enterprise software and fintech industries. Together, these business sectors accounted for almost 50% of the number of transactions.

- These are not only scientific projects (such as the ones created by graduates of the BioMed Biotts Academy), but also ventures aimed at revolutionizing the existing care system (e.g. Jutro Medical, founded by a graduate of the PFR School of Pioneers educational program) or to increase our awareness of the condition of relatives (e.g. SiDLY). It is not clear how COVID-19 influenced the financing of these projects, as a large part of them have already begun development before the epidemic and have already been attracting investors' interest. While the coronavirus pandemic has paralyzed part of the economy, many healthtech startups are booming. It is also possible that the sudden change of security has mobilized some funds to make faster decisions. - indicated Eliza Kruczkowska, Director of the PFR Innovation Development Department.

An important aspect is also the growth of Polish CVC investments, which are increasing due to capital opportunities enabling corporations to invest in long-term investments, but also due to the serious challenge, that is technological change. Today's largest market players may be replaced by rapidly growing companies in the next few years. That is why cooperation and skillfully directed CVC investments are so important.

The report prepared by PFR Ventures, i.e., the fund of funds, in cooperation with Inovo VC, was preceded by information about a record investment in the Polish start-up Booksy (link in Polish), which received $70 million in funding in round C.

- When we became the main investor in Booksy's seed round at the end of 2015, the leading method of arranging visits in the beauty & wellness sector was a telephone and a piece of paper. Currently, Booksy is the largest and most popular application in the world for booking visits in this segment, and locally, it is used by up to 40% of Poles. - said Michał Rokosz, partner at Inovo Venture Partners.

The entire report is available at the website.