Record investment value and high number of transactions - Q2 2021 on the Polish VC market report by PFR Ventures and Inovo VP

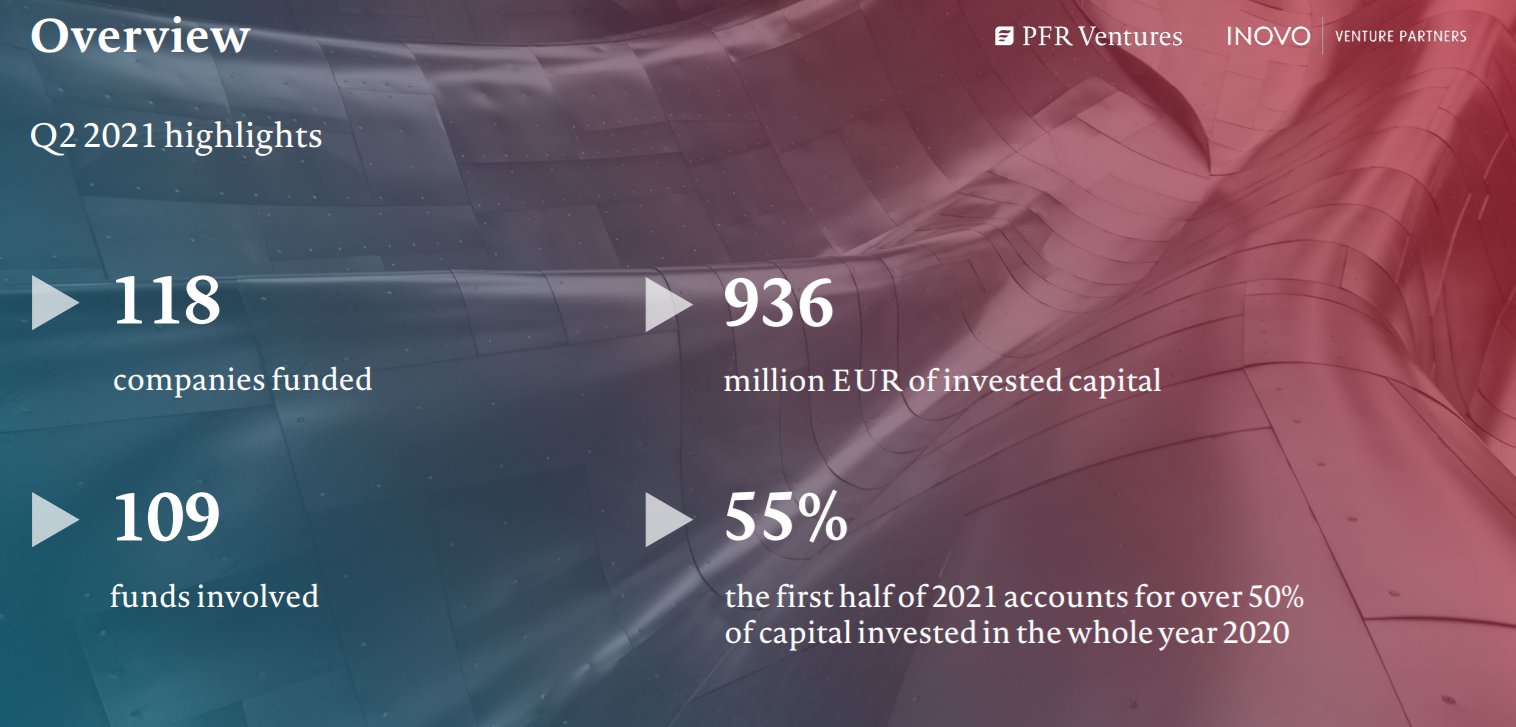

PFR Ventures and Inovo Venture Partners have published a summary of the second quarter of 2021 on the Polish venture capital market. There are reasons to be happy! They are both the high number of transactions - 118, and their value - a record 936 million PLN. Check what else has happened on the VC market in the past three months.

Data for Q2 2021 is even better if we compare it with the same period last year. 58 transactions for the amount of PLN 169 million were recorded between April and June 2020. Of course, the level of investments at that time was affected by the uncertainty related to the onset of the coronavirus pandemic, but this year's results doubled when we consider the number of transactions and more than quintupled in terms of their amount.

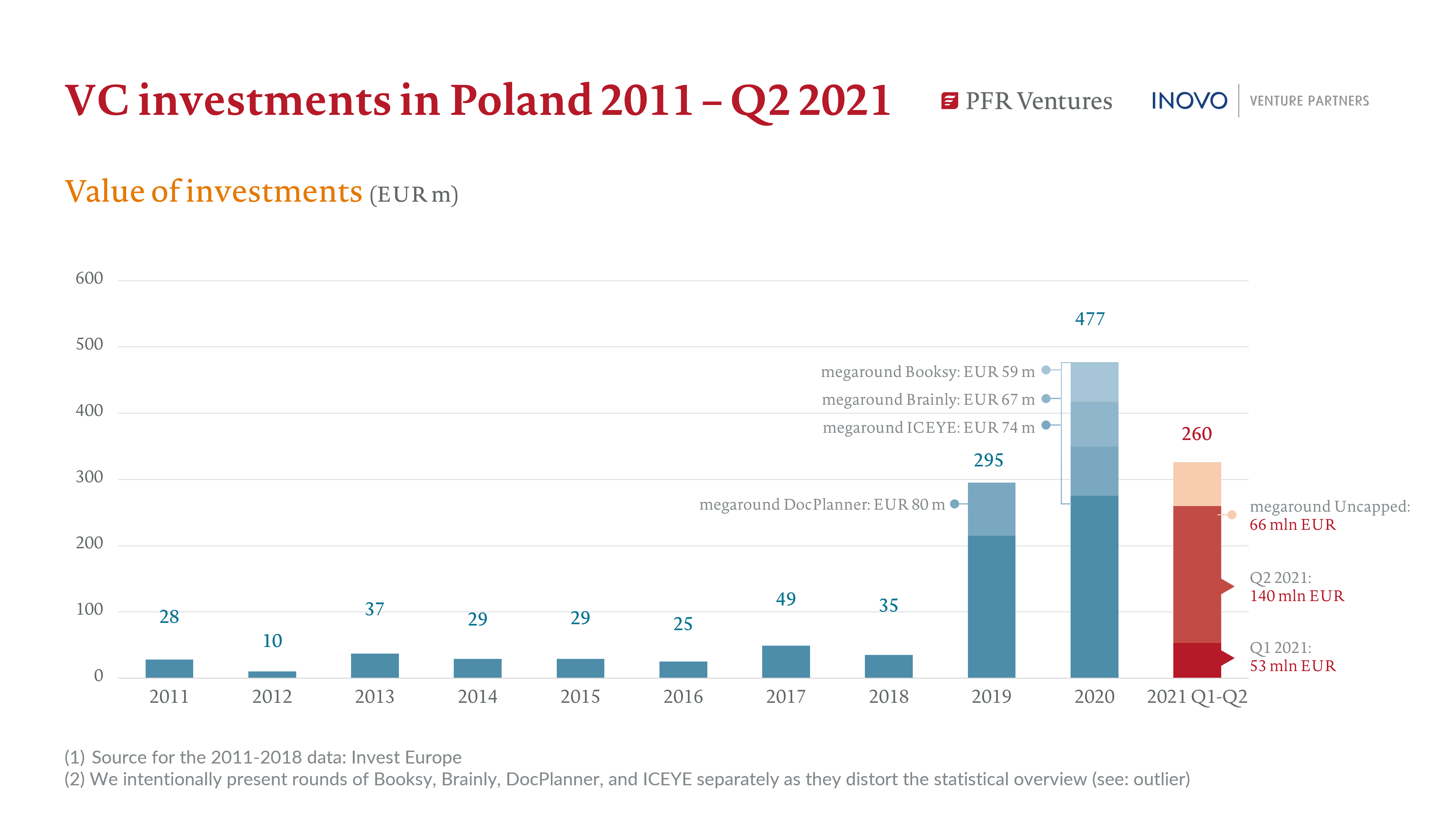

PLN 936 million mentioned is the total value of capital that Polish and foreign funds have invested in the innovative enterprises in the country this quarter. It also means that in the first half of 2021, Polish startups acquired PLN 1.17 billion from investors - this is over 55% of the value of investments throughout 2020.

- By mid-2020, the VC market reached the level of investments equal to that of the entire 2019. It is expected that the third quarter will be even stronger, which will allow us to fight for another record and break the transaction value at the level of PLN 2.1 billion. The first signals about very significant transactions appeared at the beginning of July - says Aleksander Mokrzycki, vice president at PFR Ventures.

Among the largest investments in Q2 2021, the Uncapped megaround takes the lead. The company raised as much as PLN 301 million. However, even after deducting this investment, the rest of the companies received PLN 635 million, which is still a record result - the previous highest quarterly transaction value, excluding megarounds, was recorded on the market at the end of 2020 - in Q4 2020, amounting to PLN 423 million.

- It is clearly visible that Polish technology companies are raising more and more capital and it is happening rapidly. The succeeding rounds are collected by them in less than a year, and for the record-breakers even in 4-8 months. An excellent example is Uncapped, which we have included in the report. In May, they raised PLN 301 million just after 8 months since their last round - says Tomasz Swieboda, partner at Inovo Venture Partners.

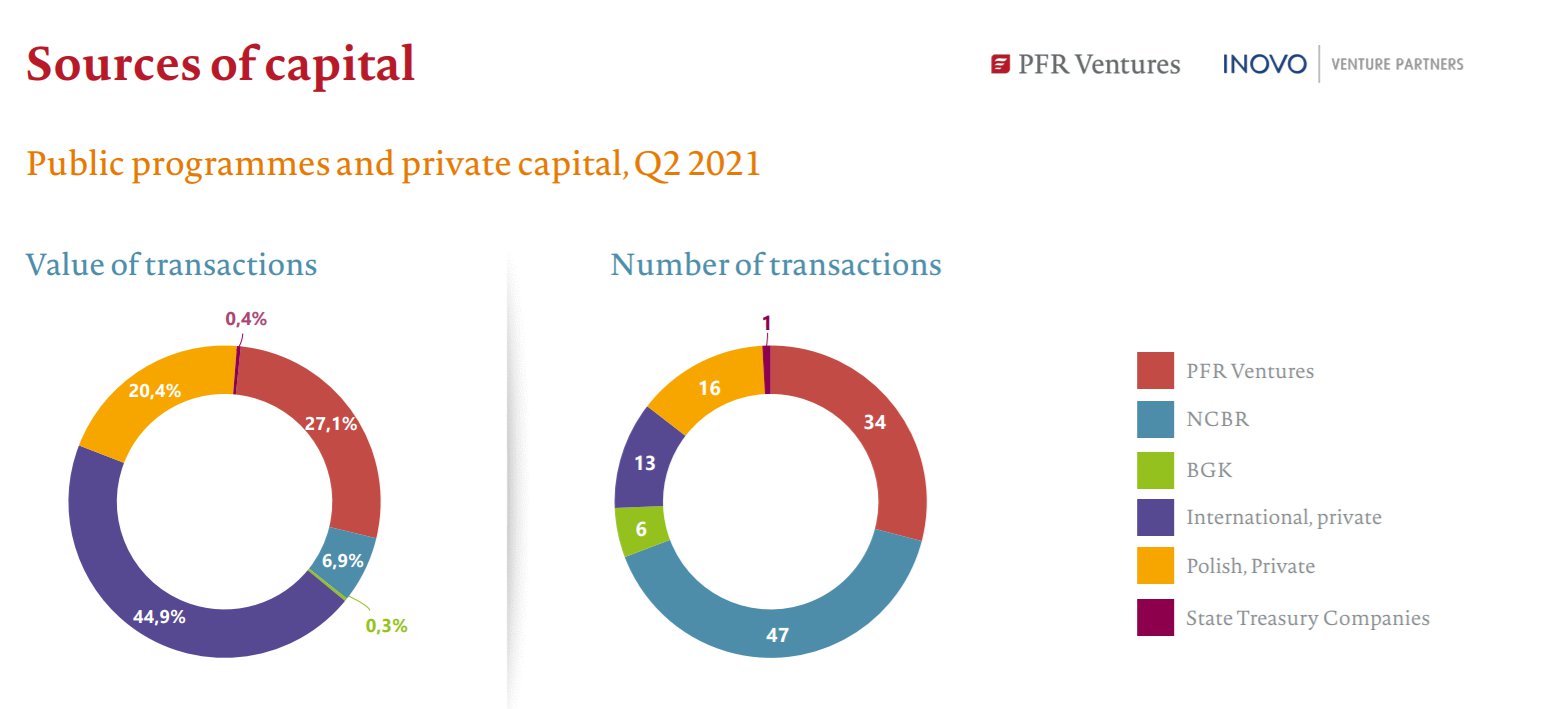

Who invests in the Polish VC market?

1/3 of the funds invested in the first quarter (34%) were provided by public-private capital, and the share of international funds in transactions amounted to as much as 61%. At the same time, public-private capital was responsible for 87 out of 117 transactions. The vast majority, 96 transactions, were carried out by Polish teams.

PFR Ventures funds are also very active - 34 out of 117 transactions are investments with their participation. The funds of the National Center for Research and Development also play an important role in the seed segment, with 47 transactions (7% share in value). At the same time, the top 15 funding rounds accounted for 71% of the value of all funding rounds in the first quarter.

- We are seeing a lot of interest coming from foreign investors. The sale of shares in skyrise.tech to the Finnish company Etteplan, which was made possible by Black Pearls VC through participation in the BRIdge Alfa program, resulted in a private return of 18.6 x CoC. For the first time on the Polish market, a VC exit from one company amounted to the return of all the investments undertaken by the fund. Because the divestment process, among others in Alfa funds will only gain in strength, we expect further spectacular transactions in the coming years - said Przemysław Kurczewski, deputy director of the National Center for Research and Development, responsible for the R&D investment area.

It is worth noting the investment in Ramp, led by the American NfX and Galaxy Digital funds, that were accompanied by Mozilla and business angels. Among the latter there was, among others Piotr Pisarz, who not only develops his own company (Uncapped), but also invests in other Polish start-ups. This way, the capital returns to Poland and the ecosystem develops.

Interestingly, the changes caused by the pandemic had a positive impact on the Polish VC funds.

- Entrepreneurs looking for financing began to pay less attention to the origin of the funds they talk to. Local presence is still important, but the importance of knowledge, skills and experience contributed by the investor to the company has relatively increased. When all meetings become virtual, the world becomes smaller. In light of this fact, it is not surprising that Polish funds are increasingly active in investing in foreign companies - pointed out Piotr Łupiński Associate in Market One Capital.

The full report, featuring more information about the most interesting transactions, business angels and Polish acceleration programs, is available on the website.