45 out of 100 "digital champions" in CEE come from Poland - Digital Poland reports

The new report of the Digital Poland Foundation summarizes the state of the CEE technology industry, focusing on the most important players in the field. These are not only startups, but also publicly listed companies. Among 100 such companies, as many as 45 come from Poland.

The Digital Poland Foundation prepared the "Digital Champions CEE" report on the basis of transparent data, with an emphasis on financial criteria. The main factor for inclusion among the champions was capitalization, and most of the company's revenues must have come from digital products and services, or items sold through digital channels. The data for the ranking was provided by Dealroom, Merger Market, and Pitchbook platforms, as well as over 40 Private Equity and VC funds.

- One of the reasons for creating Digital Champions was the fact that the entire region is not screened very well by foreign investors - they are not aware of its potential. Of course, there are various publications on CEE markets, but they mainly focus on small start-ups, and so far, no one has created a ranking of the largest digital companies from these countries - emphasized Piotr Mieczkowski, managing director of the Digital Poland foundation in an interview with startup.pfr.pl.

Digital Phoenixes, Dragons and Wolves - what does that mean?

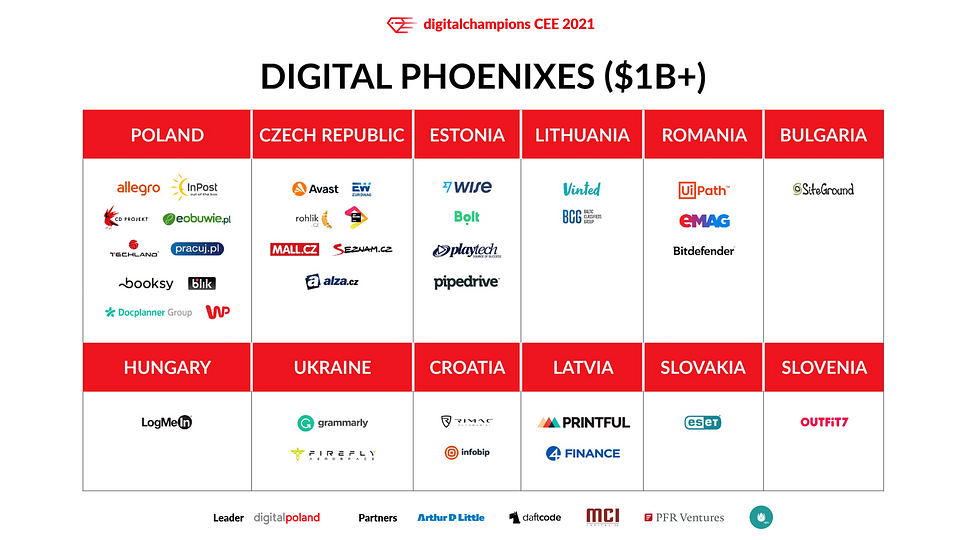

The ranking describes digital companies, while it omits unicorns - as it also includes publicly listed and bootstrapped companies. The list, therefore, includes companies that go beyond the standard definition of a startup. The Foundation categorizes companies into three groups - "Phoenixes" (companies valued at over USD1 billion), "Dragons" (between USD250 million and USD1 billion), and "Wolves" (USD100-250 million). There are 36 "Phoenixes", 25 "Dragons" and 39 of the smallest champions in CEE. Poland is a leader in the region both in terms of the number of champions, the number of "Phoenixes" and their valuation - it is as much as 45 billion dollars.

The second place in terms of the value of companies in the region may surprise - it is Romania, where there are only 6 champions, but their value is as much as USD 31 billion - the main reason for this result is the highest-valued company the entire ranking - UiPath. Third place was taken by Estonia, whose technological leaders (there are eight of them) are valued at nearly USD 20 billion, more than half of which is made up of the value of two fintech companies - Wise and Bolt.

When it comes to the number of champions, the top three include Poland, Estonia (third place), and the Czech Republic, with ten companies on the list.

Entertainment, media, e-commerce and fintech are Polish specialty

Poland definitely leads in the region, especially when it comes to three categories of companies - e-commerce, fintech, as well as media and entertainment. Among the champions, we have 14 e-commerce companies (the Czech Republic and Lithuania are second - 4 each), including Allegro, InPost and eObuwie, 11 from the Entertainment and Media category - WP, CdProjekt, Huuuge Games and Techland, and 7 fintechs (3 in Estonia) - including Blik, Aion Bank or Blue Media.

Digital Phoenixes created between 1997 and 2011 are worth the most, over USD 100 billion, and companies founded from 2002 to 2006 account for half of this amount. It was at this time that brands such as Allegro, Pracuj.pl, CD Projekt, InPost, Vinted, or UiPath and Mail.cz - the most famous big companies on the list, were created. The smallest part - only 2% of the ranking's value - is created by the youngest companies, established in the last four years. So far, there is only one Phoenix among them - Firefly Aerospace from Ukraine.

- In 2021, the CEE region will be able to recognize rising stars and provide them with seed capital that will help them grow faster. The region is still only a fraction of the European venture capital market, in which EUR 49 billion was invested in the first half of 2021. We still lag behind countries such as Germany and the United Kingdom both in terms of capital invested and the number of unicorn companies. This may change faster than we think - commented Annemarie Dalka, investment director of PFR Ventures fund. The entire report is available on the website.