High average transaction value and number of investments – Q2 2022 in the PFR Ventures and Inovo Venture Partners report

Despite the situation in the global markets being difficult, the PFR Ventures and Inovo Venture Partners report for Q2 2022 is dominated by positive information. A total of PLN 916 million was given to start-ups in VC investments and 93 companies were financed in this way. See a detailed summary of the last 3 months on the Polish VC market!

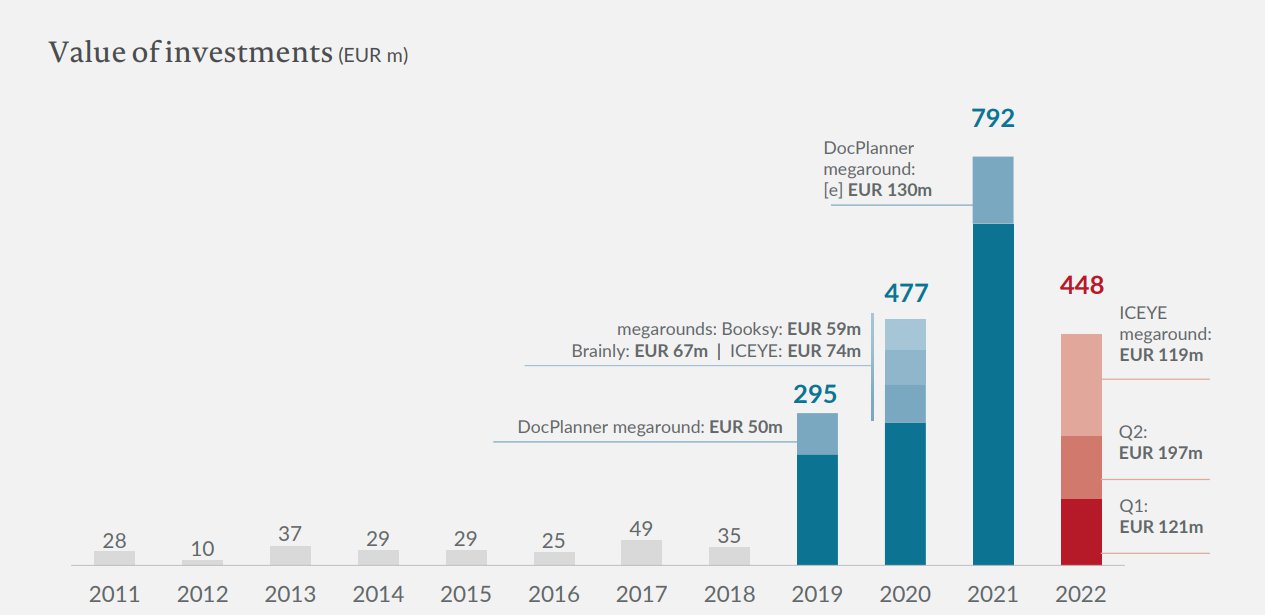

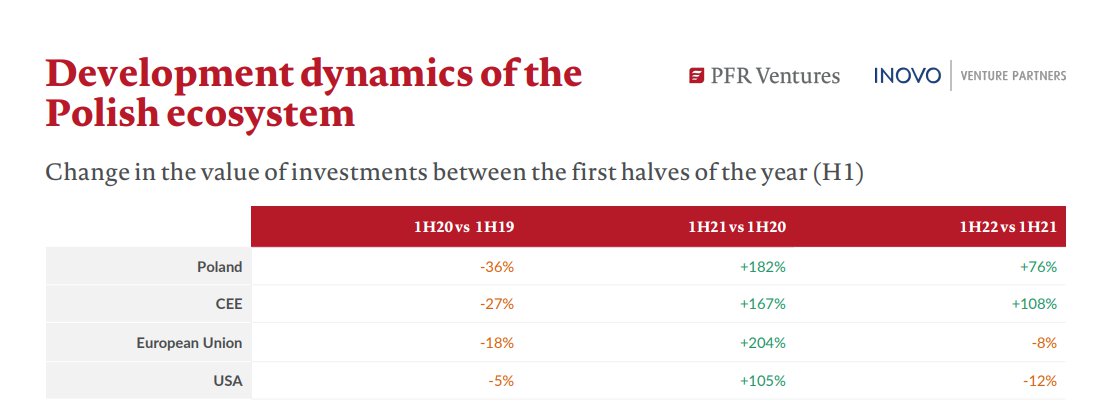

111 funds participated in the investments in the second quarter of 2022. The average value of transactions in Q2 2022 – PLN 9.9 million can be particularly pleasing. It is over 60% higher than in the previous quarter and is the second highest in history. In addition, the total value invested in technology companies in the first half of 2022 already amounted to PLN 2076 million, which means that it exceeds the similar period of 2021 by 76%. As indicated by Aleksander Mokrzycki, Vice President of the Management Board at PFR Ventures, maintaining this direction may translate into another record investment value at the end of closure of 2022.

am convinced that the market will emerge stronger and it is a good time to invest in startups, because in reality nothing has changed – we still have great engineers and more and more experienced entrepreneurs – said Karol Lasota, principal at Inovo Venture Partners.

Key information about the Polish VC market in the second quarter of 2022

- The number of completed financing rounds remains stable in relation to Q1 2022 – 93 rounds were held between April and June, i.e. 5 fewer than in the first quarter of the year.

- Compared to the same period last year, there is a greater difference – 118 to 93 rounds of financing in favour of Q2 2021, while the transaction value remains close to PLN 936 million to PLN 916 million.

- The number of investments after round A is increasing – in Q2 2022 there were 6 such transactions, and in the whole 2021 there were 12.

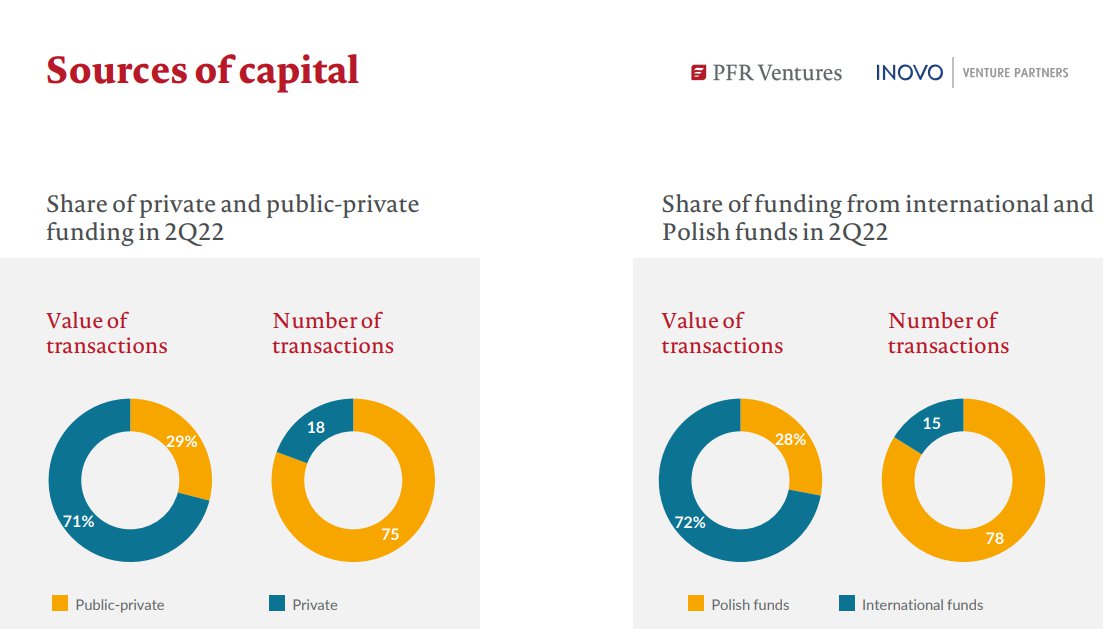

- International funds participated in only 15 out of 93 investments. At the same time, they were responsible for as much as 72% of the total financing value.

- Co-investment of Polish funds with foreign investors accounted for 43% of the invested capital in the first half of 2022.

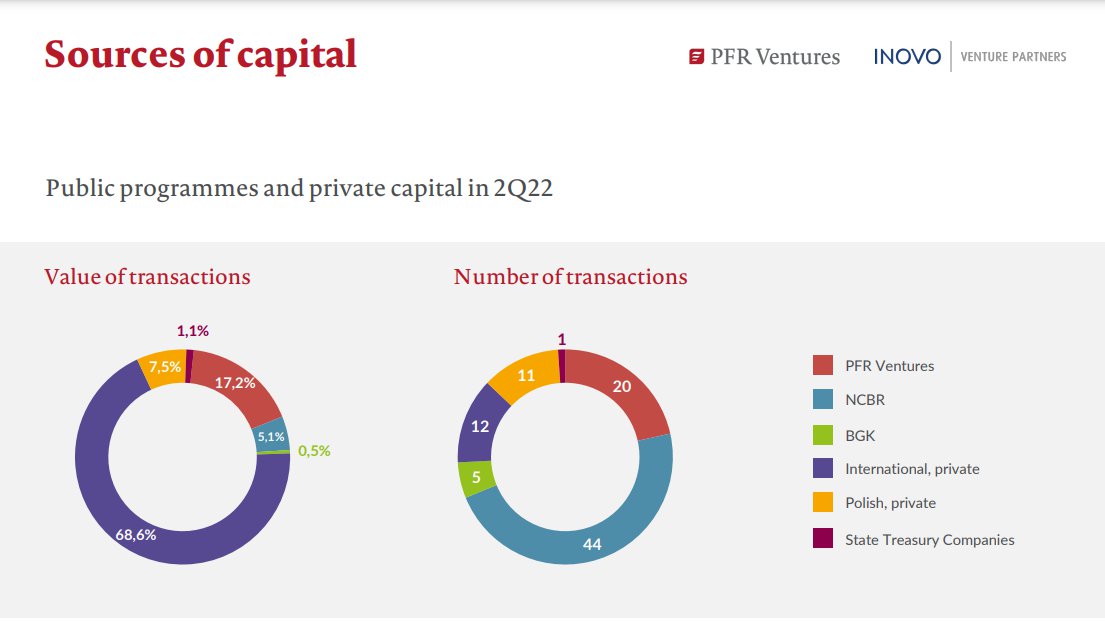

- The number of transactions is dominated by funds operating within the NCBR – 44. In second place are funds with an investment agreement with PFR Ventures – 20.

- So far, we have not really been affected by the deterioration of the overall economic situation. The value of investments was similar to the results from Q1 2022 and to Q2 2021. The same applies to the number of investments made by VC funds. It is dominated by funds created under programmes implemented by the NCBR (Bridge Alfa, Bridge VC). This situation is likely to continue for two consecutive quarters. However, uncertainty remains. Managers in NCBR funds signal that the current situation has an impact on companies seeking capital. They return to negotiations with funds that are based on public capital, and financial expectations are adjusted to new realities – commented Błażej Koczetkow, Director of the Capital Funds Department at the National Centre for Research and Development.

In what mood did investors end the quarter?

The report also included the results of a survey conducted among 26 Polish VC funds. They were asked, among others, whether, in their opinion, there will be a trend of a decrease in valuations among Polish start-ups, that is already visible in the western markets. The most popular answer (over 10 responses) was that this trend would appear, but its impact would be partial, i.e. noticeable in some investments. More than 5 votes have been received stating that this phenomenon will occur and its impact will be large or that this trend is already present in our country.

Investors were also asked what percentage of private investors, in the event of a significant deterioration of the economic situation in Poland, would withdraw their capital from local VC funds? This question was dominated by the answer of "between 21-40%", and the second place was a draw between "from 0% to 20%" and "from 41% to 60%".

In the opinion of investors, the risk that subsequent months will bring layoffs in start-ups is medium or high – in this case, the votes are divided in half.

- Our country and region are not to a large extent participants or leaders in later funding rounds, so beyond the macroeconomic situation, this phenomenon will be visible at later stages of funding and at a later stage. This does not change the fact that, regardless of the macroeconomic situation, a lot of VC funds are now armed with capital, which allows, on the one hand, to wait out a period of uncertainty, and, on the other hand, to invest in great companies regardless of this situation. These, even in difficult economic conditions, will have no problem with collecting venture funding. Sometimes bad news is good news in disguise, which is why making valuations more realistic and returning to better analysis of teams and business models in the long term is beneficial for the technology industry – pointed out Bartek Pucek, business angel and Internet creator.

You can download the full report from the PFR Ventures website.